There's been a lot of talk lately about the power of workflow automation and what it can do for a business. However, some companies are reluctant to embrace this phenomenon.

Why would an innovative organization in the 21st century ignore a concept that’s easy to implement and yields tangible advantages? The answer has to do with common misconceptions and myths that have arisen over time.

We want to clear the air by bringing your attention to these misconceptions, and to show you the realities as well. After reading this post, you’ll be better informed and positioned to move your business forward.

If you're hesitant to take advantage of workflow automation, it's high time you changed your mind. Here are the most common misconceptions about automation, which have held back many businesses from progressing. Clarifying these misconceptions will enable you to think differently and propel your accounts payable (AP) team to the next level.

Misconception #1: “Automation is too expensive.”

Most business owners incorrectly think that automation costs an arm and a leg, so they tell themselves they can't afford it. In reality, you can't afford to run your workflows manually anymore.

The cost of manual operation far outweighs the cost of running an automated system. Accounts payable automation is undeniably an investment that yields great returns.

Manual invoice processing is expensive. It leaves you wide open to errors that cost you additional time and money. But with the right accounts payable automation program in place, you quickly and easily prevent these mistakes from ever taking place.

Furthermore, an accounts payable automation tool offered as a cloud-based, software-as-a-service solution (like Pyrus) doesn't require upfront purchases or recurring license maintenance. It's designed to fit any budget, and your AP team won't have to pay exorbitant rates to use it. It doesn't even require updates from your end, as the service provider will manage regular upgrades.

Choosing this type of workflow solution enables organizations to get quicker returns on their investment. Just think of the costs you'll be saving when you eliminate errors, duplicate payments, failed audits, missed discounts, late payment charges, and forgotten credits.

Misconception #2: “We're too small/big for automation.”

If you think your AP team or organization is too small or too big for automation, you ought to reconsider.

The size of your company does not determine whether or not you need to automate your AP. Your team’s needs do. You can't afford to keep using an error-prone or outdated system.

Automation wasn't designed for teams of a certain size. In fact, larger AP teams need workflow automation to effectively manage and process a higher volume of invoices to save costs. Likewise, small teams will benefit when they leverage accounts payable automation software to streamline their processes, save costs, avert errors, and free up staffers’ time to carry out more important tasks.

Imagine what you lose when your employees spend hours manually entering invoice data, when they could be carrying out higher-level strategies, like spend management.

Misconception #3: “We'd lose visibility and control over our processes.”

If you think that automation will result in a loss of control and visibility, then you’re simply incorrect.

Workflow automation software provides greater visibility and control. When an invoice is entered into the system, you can set its workflow rules according to your team's needs, alter protocols between processes without stopping workflow, determine who has access to it, and more. You have total control over the process, and can make any adjustment you want at any time.

Likewise, managing visibility is a cinch as you can easily view an invoice’s status at any time, monitor employees’ progress, and even retrieve and review past documents.

This means invoices will no longer be lost or forgotten under a worker's desk, employees can be held accountable for their role in the invoice process, and management will be able to more easily drive efficiency and analyze reports.

Misconception #4: “Automation is too technical.”

Workflow automation is technology-based, but don't make the mistake of thinking it is high-tech and reserved for the technologically minded. Although there are some sophisticated products on the market, just as many of them are easy to use.

In fact, anybody who can use a smartphone can use a workflow automation tool. Automation tools like Pyrus are even available as mobile apps for Android and iOS.

Others are simple web applications, and don’t require any programming skills to use.

Misconception #5: “Automation is too complex and time-consuming to implement.”

You might think that setting up an automation solution is a complex process that will cost you too much time to be worth it, but that's just another misconception.

Making changes to an integral part of your company's business process can of course be challenging, but implementing workflow automation is not as complex and time-consuming as you may think. The reality is that you can smoothly continue with your invoice processes while your old system is phased out.

Automation software providers will even work with you to implement the new system and help you with setting up workflow rules in order to accelerate the process and make it as painless as possible.

Misconception #6: “Accounts payable automation has more security risks.”

Reports of illegal hacks, data loss, and information leakage have motivated many businesses to distrust online data storage and store their data locally. While experts are finding ways to improve online data security, a traditional invoice processing system is still more prone to security risk and human error.

For instance, an older system is vulnerable to issues like mistakenly wiping out data from your local database, data theft (since there are no passwords or encryption), loss of paper-based data, or even other disasters like floods or fire.

With automated AP in place, password protection and encryption protocols provide several layers of security, and you get complete control over who has access to your accounting system.

Misconception #7: “Automation will steal my job.”

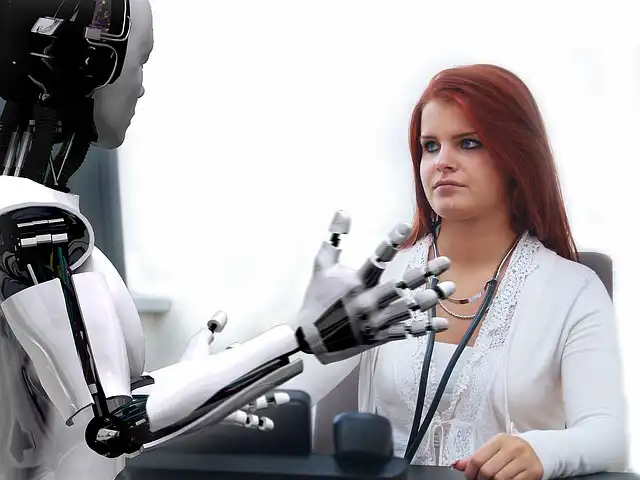

This is perhaps the most common misconception. Staffers believe automation will take over their jobs, while C-level executives believe their workers will become redundant when tasks are automated.

Here's the truth: automation is not robotic. Sure, it does all the repetitive stuff automatically, but it doesn’t make the human element redundant. In fact, it needs the human element in order to work properly. Business automation will not steal your job and it won't make your workers useless. Instead, it will increase productivity, reduce costs of time and money, and improve your company's overall bottom line.

Automation is about creating an environment for your AP team to be more productive and efficient. It's about taking those boring, annoying tasks and turning them around for your benefit while giving your team the time to work on worthwhile endeavors.

Are any of the above misconceptions holding your business back from operating more efficiently? The truth is, CFOs and accounts payable managers can easily improve their invoice processes by implementing accounts payable automation without experiencing any of the above concerns. Make the best use of your time and resources by automating your accounts payable workflows today.

We recommend you start with Pyrus, the most innovative accounts payable automation tool trusted by thousands of people around the world. You can start using it today for free. Just complete the form below.

Request a demo of the Pyrus accounts payable solution